The purpose of this documentation is to outline the uses, cases,

and processes associated with Landed Costs. Landed costs are the total cost of

a landed shipment including:

Purchase Price

Freight

Insurance

Other Costs up to the Port of Destination.

In some instances, it may also include the customs duties and other taxes levied on the shipment. In other words, landed costs are: The total price of a product once it has arrived at a buyer’s door (Cost of Product + Shipping + Customs + Risk).

Processes

Enabling Landed Costs

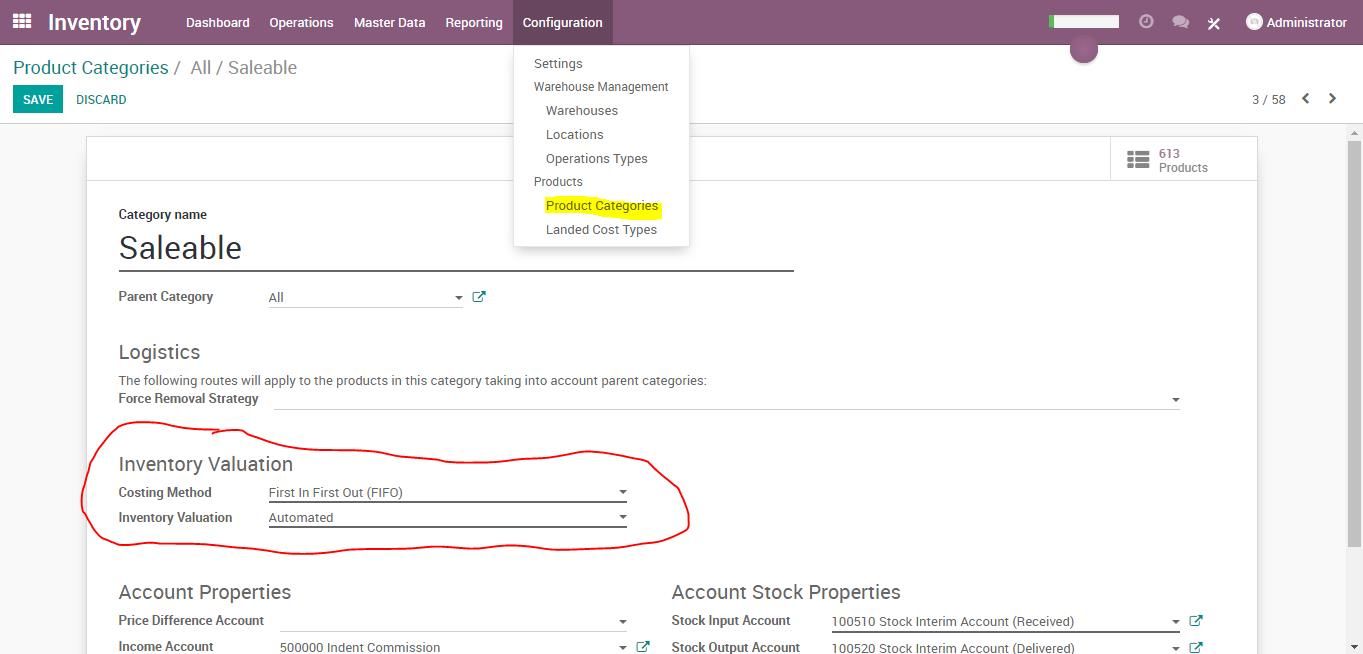

Once there, click on CONFIGURATION > SETTINGS.

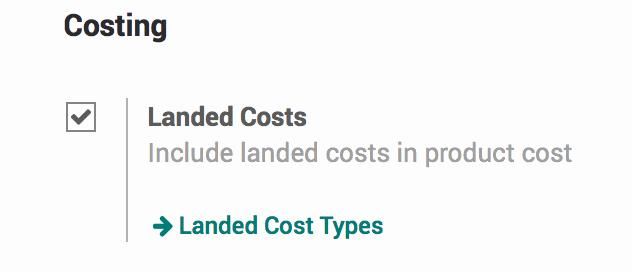

Scroll down to the Costing section and check the checkbox for Landed Costs.

When ready, hit the SAVE button.

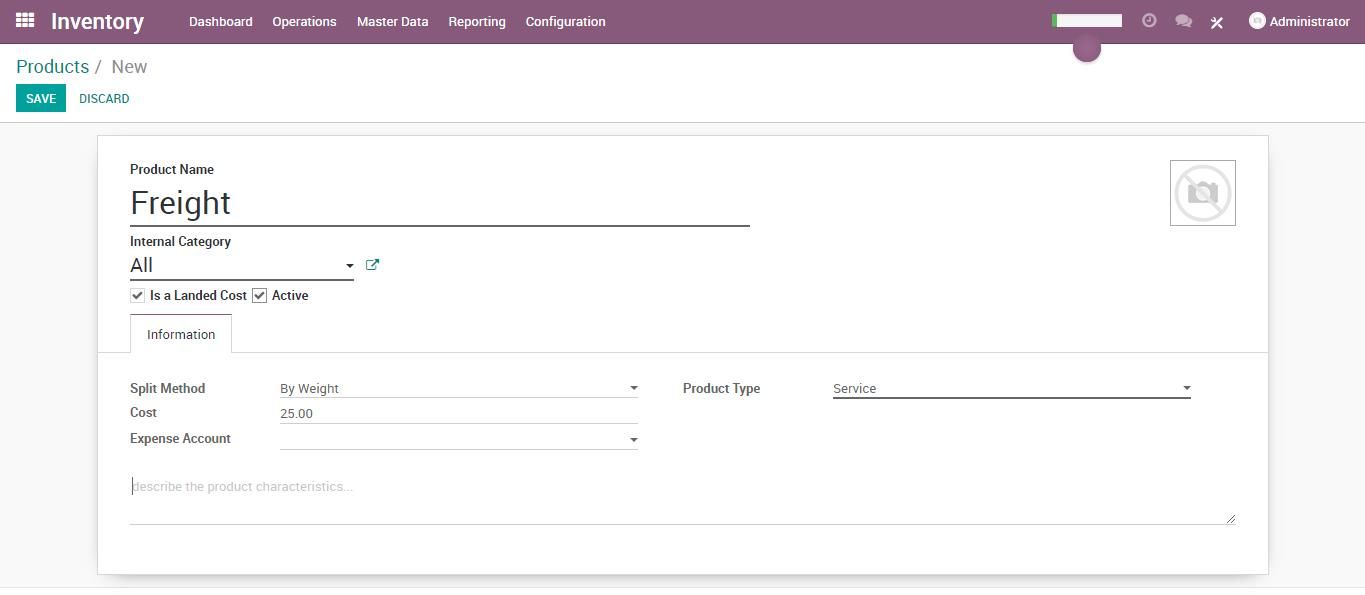

Configuring Landed Cost Types

Click on CONFIGURATION > LANDED COST TYPES.

Here you will see a Kanban view

of Landed Cost products. Landed Cost products are products that have the 'Is a

Landed Cost' checkbox selected.

Hit the CREATE button.

Fill in the following details:

Name: The name of the Landed Cost.

Split Method: Select a Split Method, the types of which are outlined below in more detail.

Expense Account: This should be an expense account that makes sense for the product.

Product Type: Select the appropriate product type; in most cases this will be Service.

When ready, hit the SAVE button.

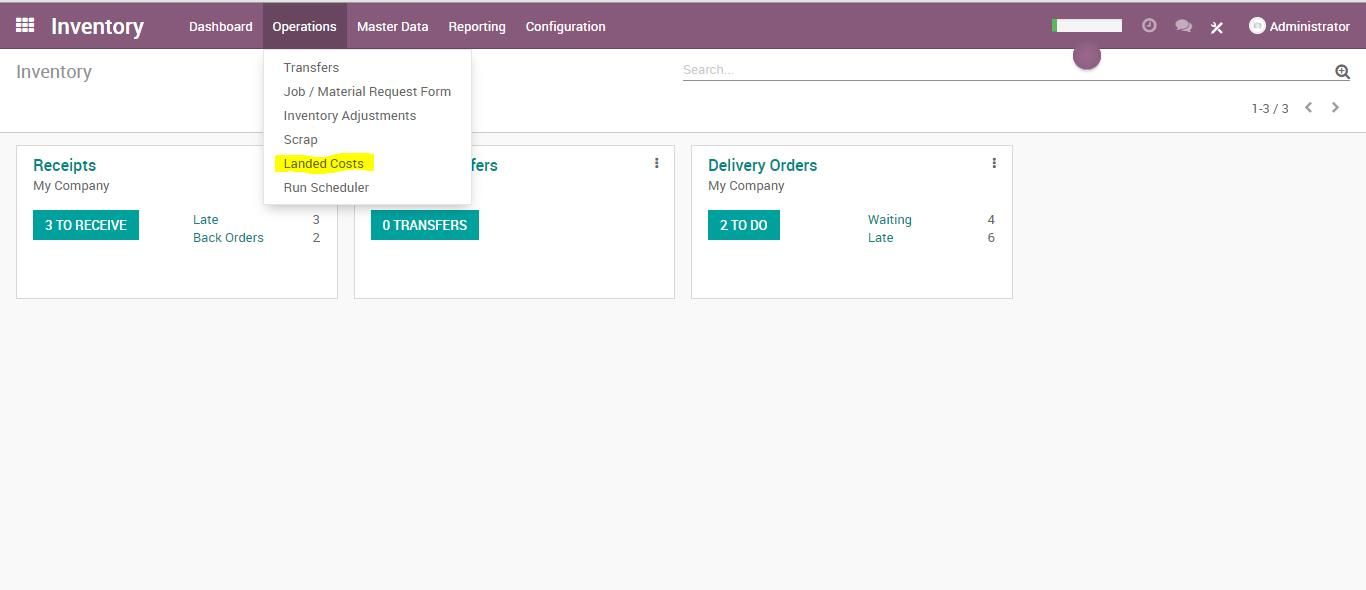

Linking a Landed Cost to a Warehouse Transfer

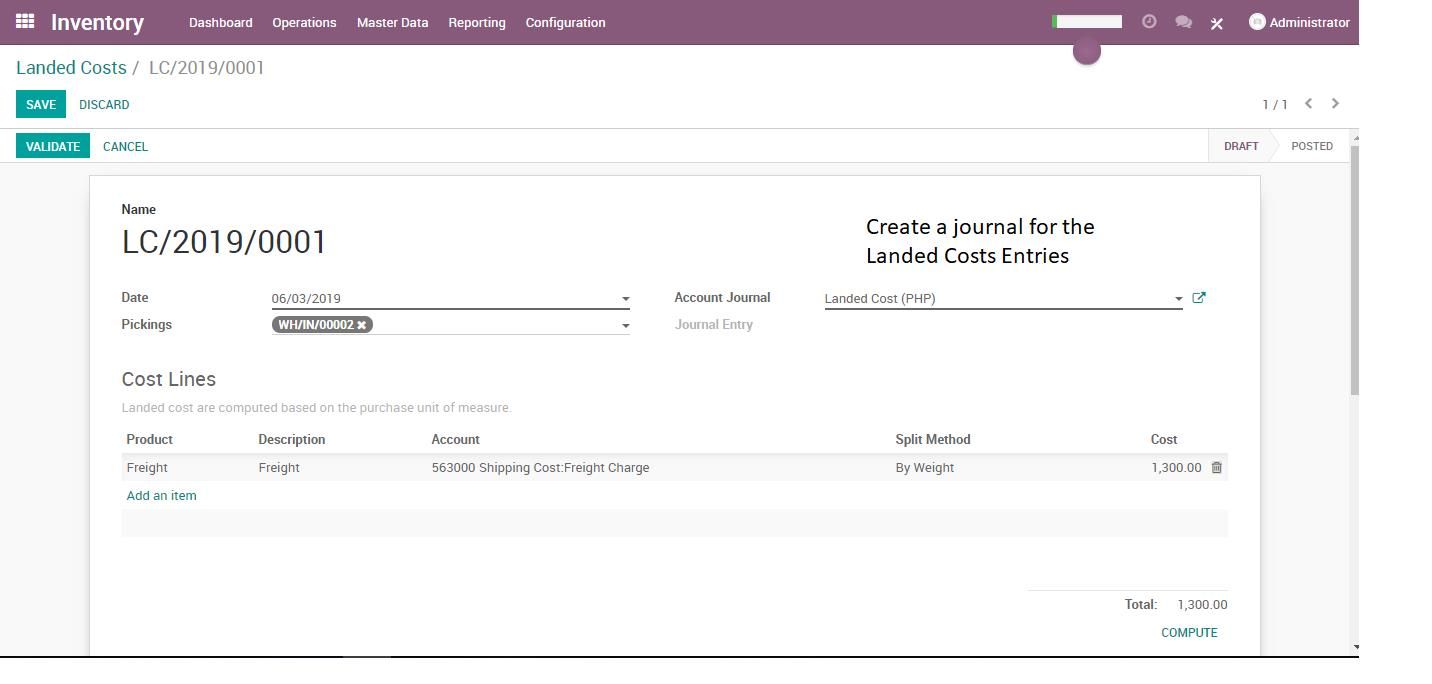

Now, click on OPERATIONS > LANDED COSTS. Hit the CREATE button.

Fill in the following details:

Transfers: Select the transfers you want to attribute landed costs to from the drop-down menu.

Account Journal: The journal in which you want to post the landed costs.

Cost Lines: Click ADD AN ITEM to add a previously created Landed Cost Type. Add as many cost lines as needed.

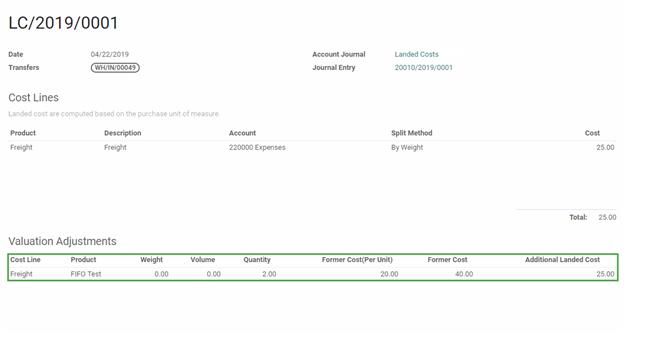

When finished, click COMPUTE.

New lines will appear underneath Valuation Adjustments with the additional landed cost for each picking.

When ready, hit the SAVE button followed by the VALIDATE button.

Upon validation, a journal entry will be created in the previously selected Account Journal. You will have a link to the Journal Entry Field.

*NOTE: Costing method of the Product should be set in FIFO and the Inventory Valuation should be automatic to work.