To meet a certain requirement, most countries use a tax system. In every accounting system, tax element is a must. We may create various types of taxes in Odoo.

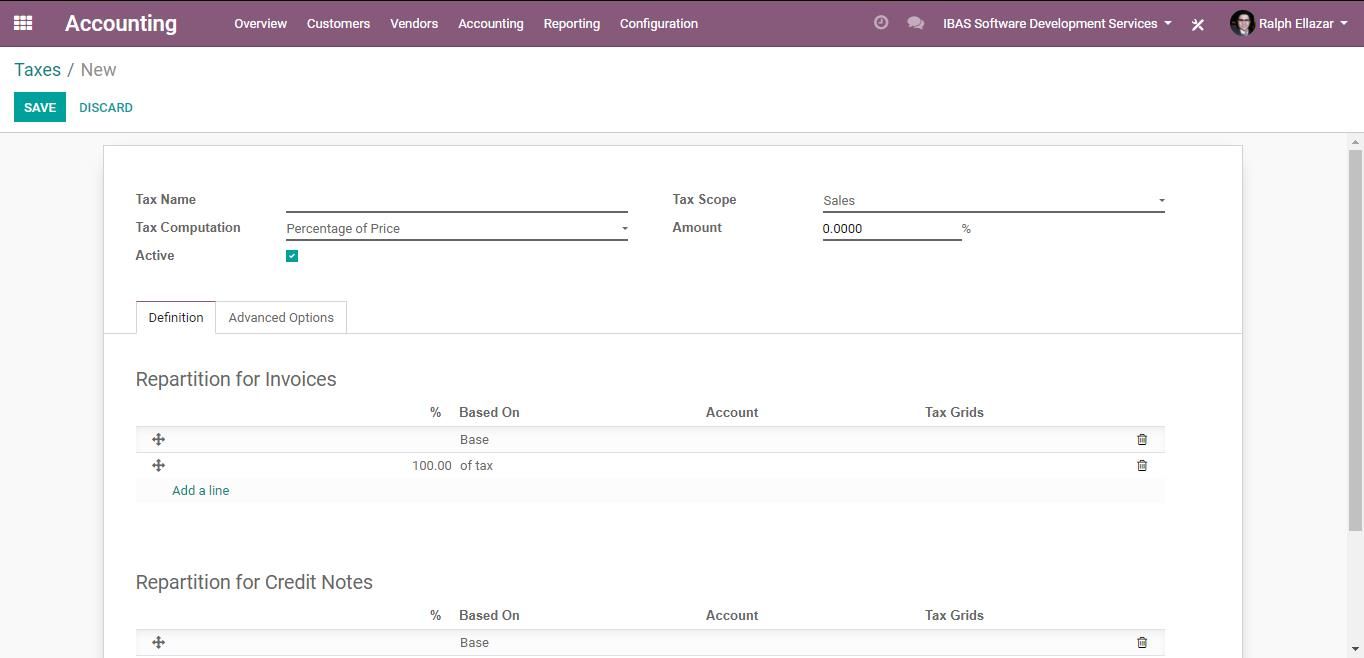

To create a new tax, we shall go to Accounting>Configuration>Taxes. From there, we can then create new taxes.

Here are the mandatory fields:

Tax Name;

Tax Scope - It implies where this tax will be used, in Sales or Purchase. If you choose 'None' it will be used with other tax groups;

Tax Computation - has four default types of tax computation. Group of Tax, Fixed, Percentage of Price, Percentage of Price Tax Included;

Amount - only appears if the tax computation is Fixed, Percentage of Price or Percentage of Price Tax Included. Tick Active if this tax is active. Only then it can be used;

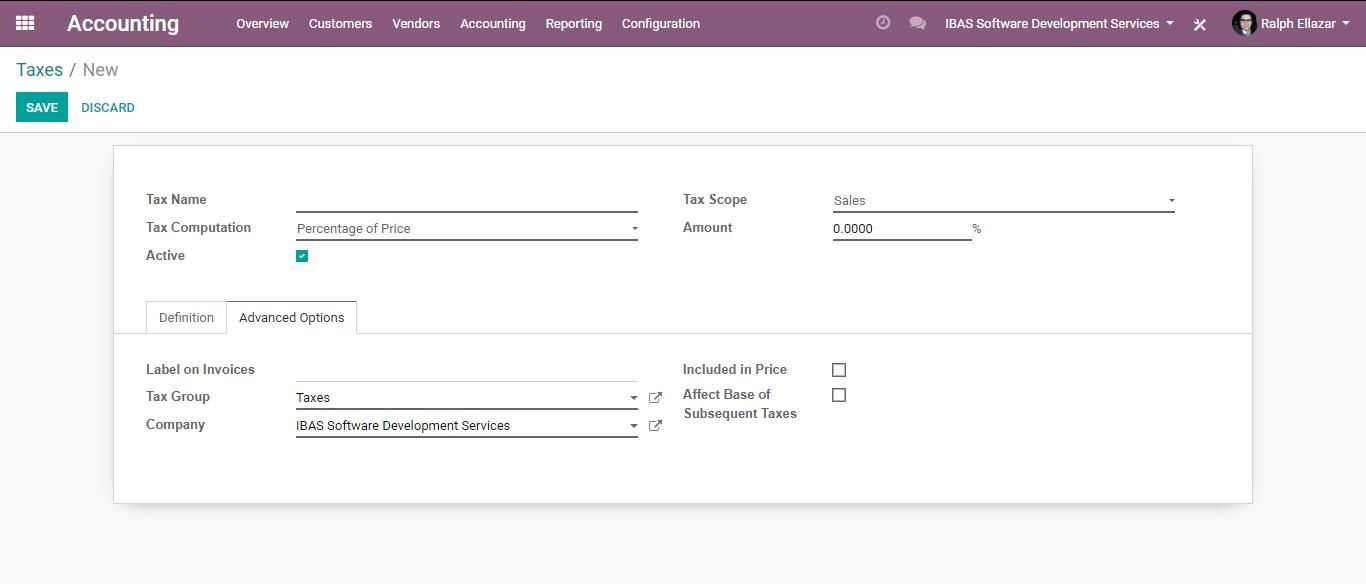

Label on Invoices - what we mention here is used in the invoice report;

Write the Tax Group you created.

When Included in Price is enabled, the tax amount will be deducted in the unit price of the product.

When Affect Base of Subsequent Taxes is enabled, the total of the current base amount of the tax rate of this tax will be the base rate of subsequent taxes.

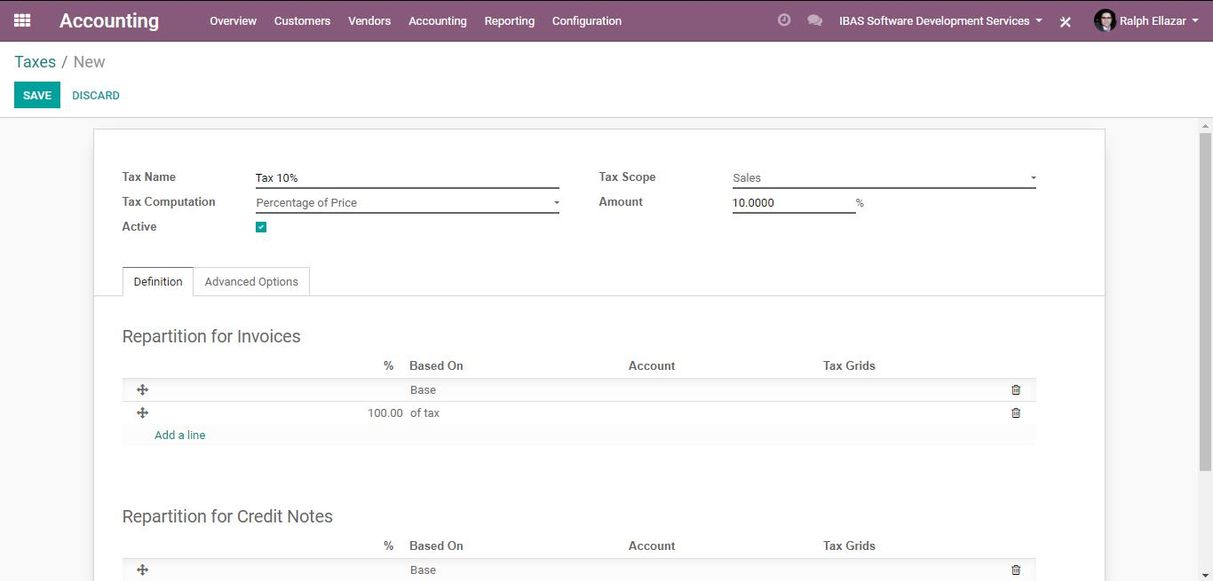

Percentage of Price is the most used way of tax computation.

For example: Base amount is: 1000

Tax amount is: 10%

Tax is: 100

So, the amount with tax is: 1100 (tax is included in the price)

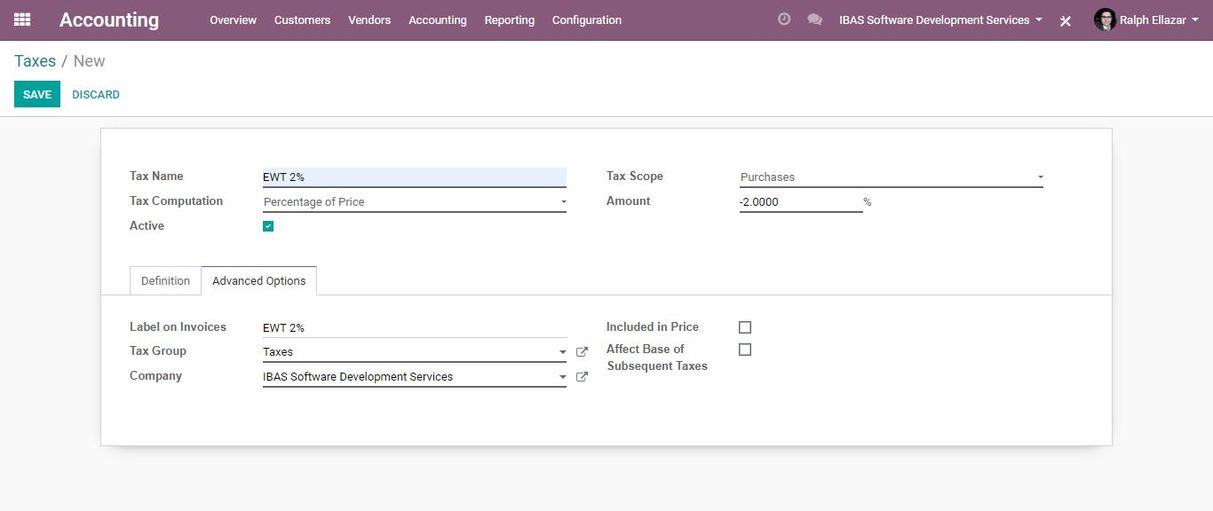

For Expanded Withholding Tax (EWT)

To set up EWT, Tax Scope should be Purchases, because we usually apply EWT when we purchase goods, services, rentals, etc. Then the Amount should have a negative (-) sign.

For Example, if its deductible by 2%, it should be -2.

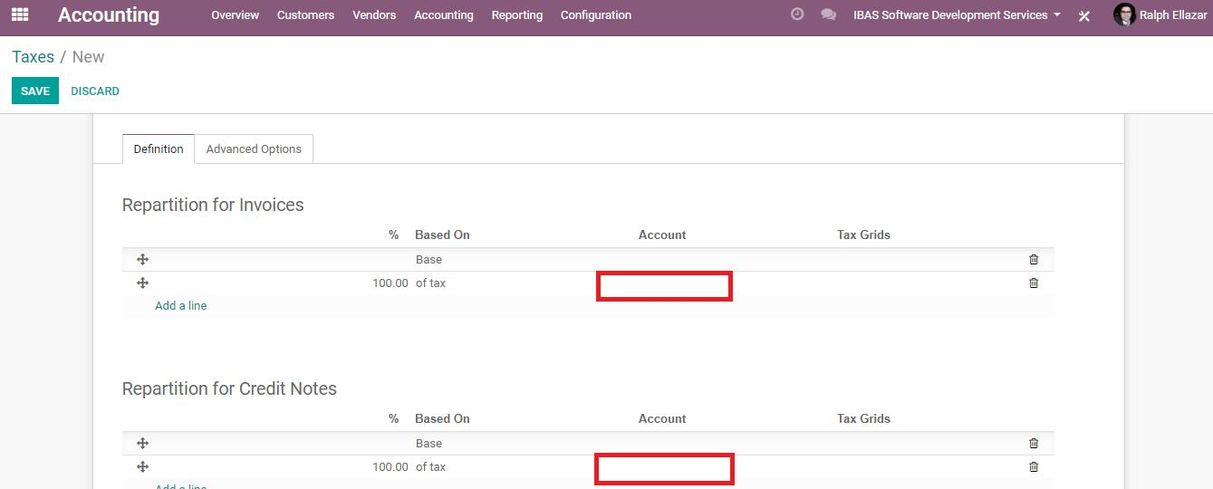

Also, do not forget to set the right General Ledger (GL) account assigned to that tax.

These are all the information we need to look after when configuring taxes in

Odoo!