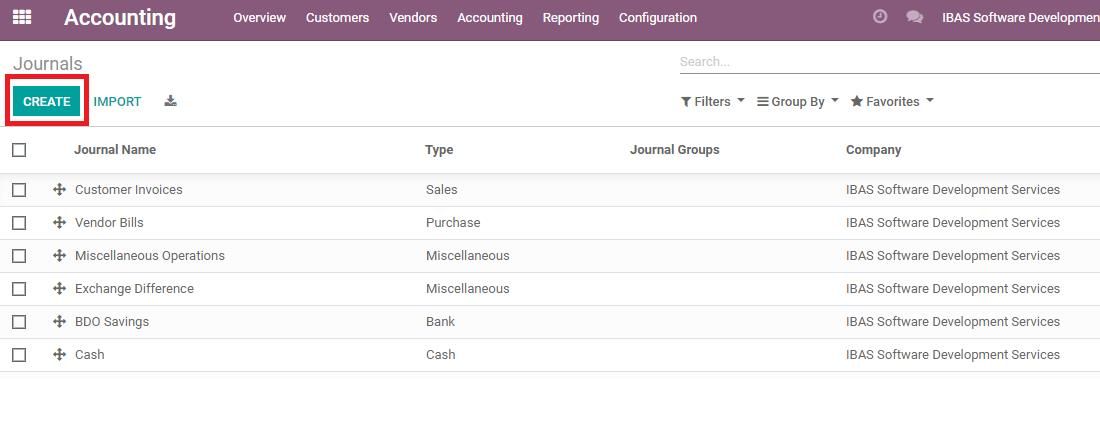

Journal

Create a new Deferred "Expense" Journal with preferred options

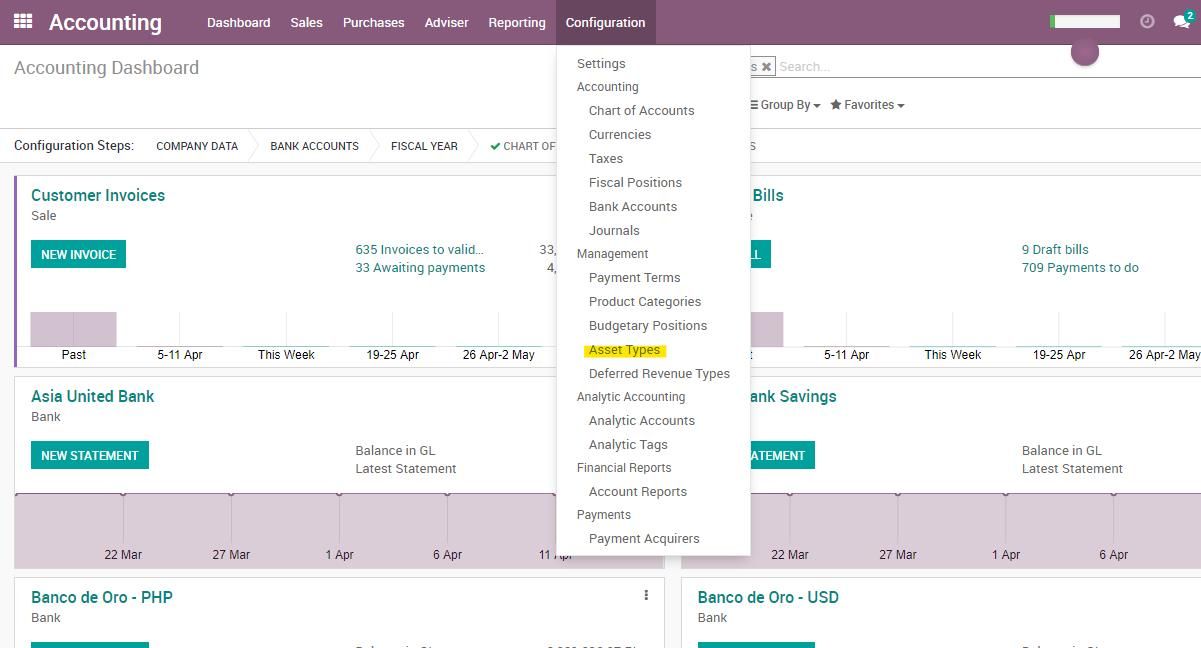

Asset Type

Go to Accounting>Config>Asset Type

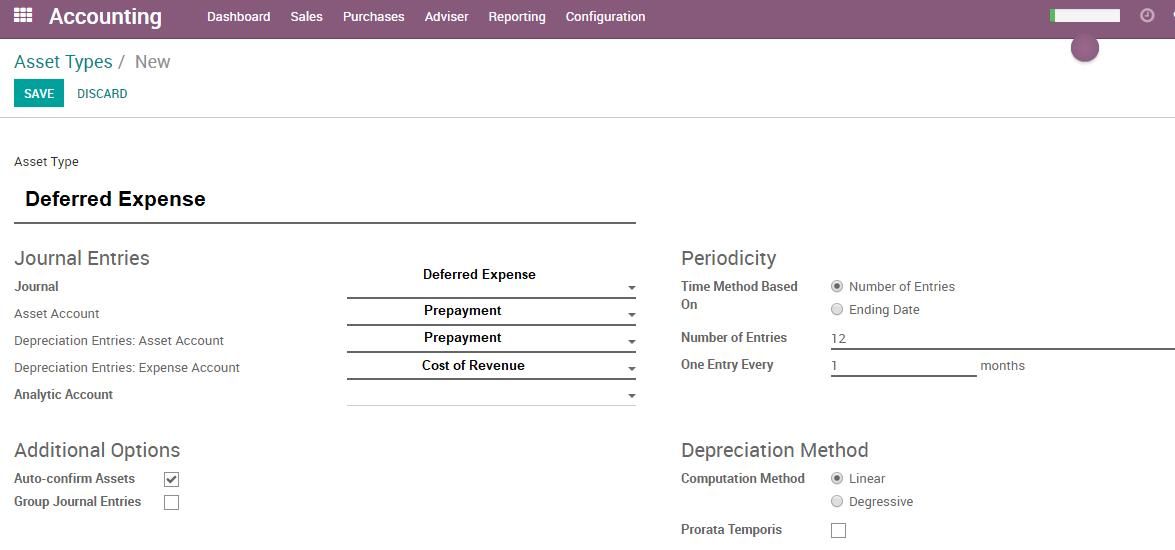

Create a new asset type named "Deferred Expense"

Set the Journal to "Deferred Expense"

Asset Account → Prepayment

Depreciation Entries: Asset Account → Prepayment

Depreciation Entries: Expense Account → Cost of revenue

Auto-confirm Assets → True

Number of Entries → 12

One entry every → 1 month

Product

Create/ open product

Go to invoicing tab

Set the asset type to "Deferred Expense"

Set the Expense Account to "Prepayment"

Create PO

Create PO and select the product you created.

Make sure that the product is set correctly with the expense account.

Select the asset type in the PO Line.

Confirm PO.

Vendor

Create a vendor bill and validate the invoice.

Check the journal entries.

Now go to the Accounting> Advisor> Assets.

Review the asset that is created and post entries.

Logic to post:

Vendor bill → Creditor Credited and Prepayment Debited

Posting of the first-month → Prepayment is credited and COGS is debited